Automatic Built-in Stablisers (Automatic Stabilizers)

Overview of Automatic Built-in Stabilisers (Automatic Stabilizers)

Automatic stabilizers are fiscal policy tools. Hence, just like typical fiscal levers, they can be in the form of taxation control, or welfare benefits. However, unlike discretionary fiscal policy, these automatic stabilizers do not require approval from legislators in the parliament. They are built into government budgets, and they will self-adjust and adapt its intervention based on the state of the economy.

Automatically stabilising the economy during recession

Take for instance an income tax of 10 percent. If a household earns $100,000 in a given year, they will need to pay $10,000 of income taxes. During recession, the annual household income may decline to $50,000. If the same tax rate of 10 percent, this household will only need to pay $5,000 of income tax. This effectively cushions the financial burden on the affected household.

At the same time, more households may qualify for unemployment benefits payout as unemployment rate increases.

Taken together, these measures mitigate the drop in aggregate demand during a recessionary period. This is achieved by increasing government spending (G), and dampening the fall in consumer spending (C) via reducing taxes (T).

Automatically stabilising the economy during high inflation

During periods of high inflation, these automatic stabilizers would automatically adjust its fiscal tools so that it reduces its fund injection into the economy.

For instance, let’s take the example where an economy is operating beyond its full employment rate, and is facing high inflation. A typical household may earn $150,000 per year, higher than its normal $100,000 per year. At the same tax rate of 10 percent, this household will need to pay $15,000 of income taxes (higher taxes than usual).

At the same time, less households will qualify for unemployment benefits.

In essence, these interventions will help to dampen the aggregate demand during a high inflationary period. Essentially, as there are less unemployment benefits, the government spending (G) is corresponding reduced. Additionally, there are also less consumer spending (C) as taxes (T) are increased.

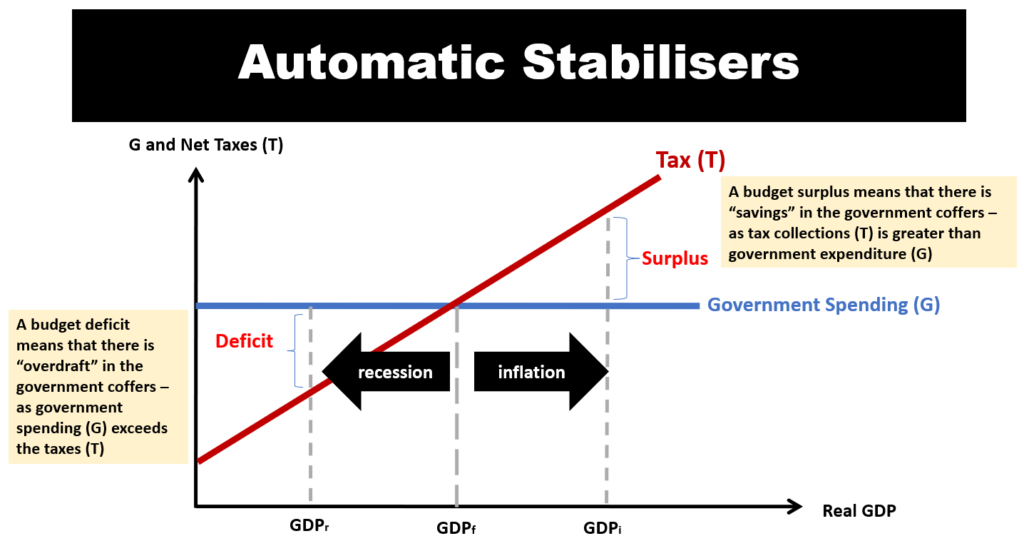

Automatic fiscal policy tools that adjusts based on ecnomic conditions

- At full employment, the national output is at (GDPf). The country’s budget should be balanced.

- When this country enters into recession, the GDP is now at GDPr (that is less than full employment at GDPf). At this point, the built-in stabiliser kicks-in by increasing the deficit. That is, funds are used to increase the Aggregate Demand (AD). This essentially means that there will be more government spending than taxes.

- On the other hand, if the country enters into a high inflationary scenario, and that its GDP is at GDPi (that is higher than its full employment level at GDPf). The automatic stabilizers will create a surplus in the government budget. This is because the amount of tax collections will be more than the amount of government spending.