Fiscal Policy

Government has a role to ensure that the economy is healthy and remains so. This means that most businesses can make money and grow, most people can find jobs, and prices of goods and services don’t change dramatically. The government uses fiscal policy to manage the economy.

Fiscal policy involves the government making adjustments to how they spend money and tax people. By calibrating these two things properly, the government can stabilize the economy as it moves through the different phases of the business cycle. The government also use the same tools to help the economy grow and expand overtime.

The government has a dedicated department that administers the fiscal policy directly. In contrast, monetary policy, another macroeconomic tool is managed the country’s central bank.

There are two types of fiscal policies. The first type of fiscal policy is called ‘Automatic Built-in Stabilisers‘. The type of policy has mechanisms built into existing programmes such as income tax and unemployment benefits. As such, these policies do not require additional approval from parliament.

On the other hand, ‘discretionary fiscal policy’, the second type of fiscal policy, requires government to seek extraordinary budget approval from the parliament.

When the economy experiences huge shocks, automatic stabilisers alone may not be sufficient to stabilise the economy. Hence, a discretionary fiscal policy may be required.

Expansionary Fiscal Policy

During a recession, the government will pursue an expansionary fiscal policy to stimulate the economy and reduce unemployment.

The government can achieve this by reducing taxes, increasing government expenditure, or both. These interventions release purchasing power into the economy to help boost consumption. In turn, this will help to increase the Gross Domestic Product (GDP). In essence, expansionary fiscal policy has the following aims:

- To counter the effects of booms and slumps and to maintain economic stability

- To raise the general price level of real income and aggregate demand

- To redistribute income and resources

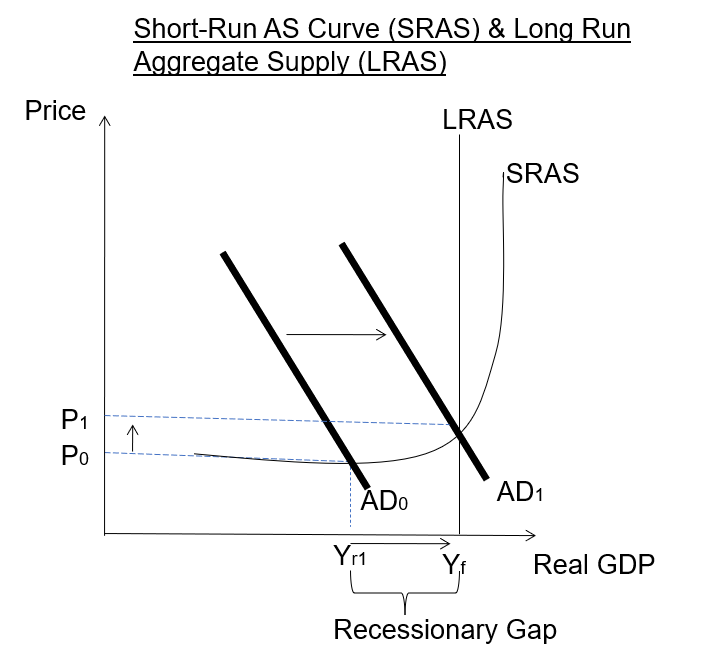

Let’s assume that the country is initially at real GDP level of Yr1 given by a certain Aggregate Demand (AD0) and an Aggregate Supply (SRAS).

At Yr1, the economy is in a recession with an unemployment level higher than its natural unemployment rate.

Hence, the government uses expansionary fiscal policy, either via a reduction in taxes or an increase in government spending (or both), to shift the aggregate demand from AD0 to AD1. This will close the recessionary gap and enable the economy to move to its full employment level at Yf.

Contractionary Fiscal Policy

When the economy is experiencing high inflation, the government can engineer a discretionary contractionary fiscal policy. This can help cool down the overheated economy in order to rein in the high inflation.

The government can achieve this by either raising taxes, or reducing government expenditure, or both. However, the government does not typically use these interventions as they may make the government lose popularity.

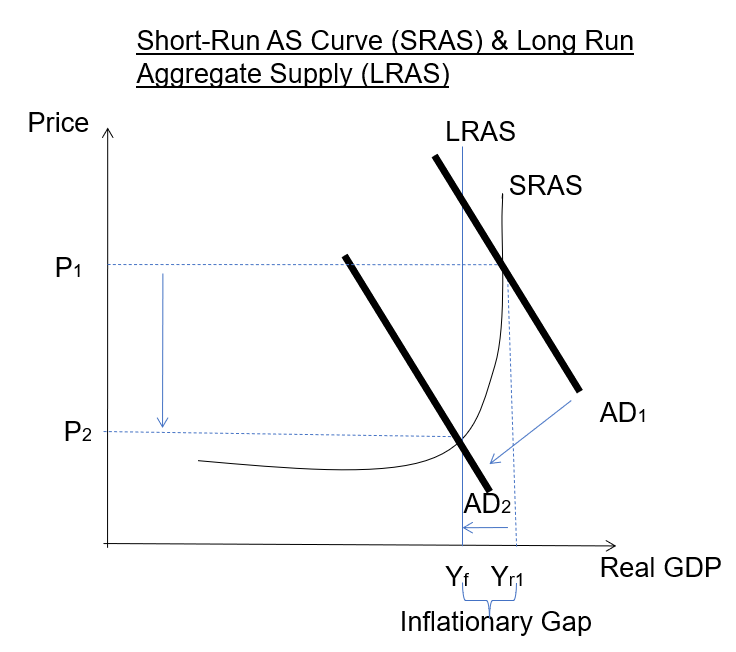

Let’s assume that the country is initially at real GDP of Yr1.

At this point, the country has an unemployment rate lower than its natural unemployment rate. The economy’s inflation rate will be high and this makes everyone worse off as their money can buy less items.

To reduce the inflationary pressure, the government can engineer a contractionary fiscal policy, either by increasing taxes, or reducing government expenditure (or both), to shift the Aggregate Demand from AD1 to AD2. This will close the inflationary gap and enable the economy to move towards its full employment level at Yf.