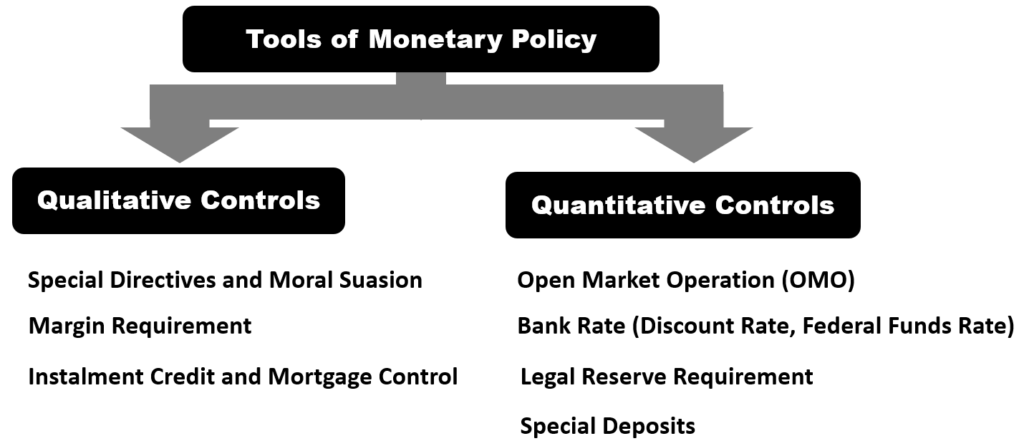

Tools of Monetary Policy

Central Bank's Monetary Policy Levers

The Central Bank may use various policy levers to influence commercial banks’ lending policy with the aim to controlling the money supply. These policy levers include reserve requirement ratio, bank discount rate, open market operations, and more. In other words, Central Bank makes adjustments to these levers to institute expansionary monetary policy and contractionary monetary policy.

Qualitative Controls

1. Special Directives and Moral Suasion

These are instructions to commercial banks asking them to be either more liberal in their lending policy in times of recession or to be more stringent in their leading in times of inflation. If the instructions are passed down in the written form the method is known as special directives; but if they are communicated verbally, then it will be known as moral suasion.

The commercial banks usually heed these directives from the Central bank rather than be forced into obeying them as the Central bank can use such strong measures as refusal to rediscount bills for the commercial bank whose credit policies are not in accordance with the Central bank’s wishes.

2. Margin Requirement

The margin requirement refers to the amount of money that an investor must deposit to buy a stock. For instance, if the margin requirement on the stock is 60%, the buyer must put up 60% of the purchase of the stock using his own money and can borrow no more than 40% from banks to finance his stock purchase.

If the margin requirement is decreased, then more stock can be purchased using the same amount of cash at hand. This effectively will lead to increasing the overall money supply.

On the other hand, if the margin requirement is increased, then less stock can be purchased using the same amount of cash at hand. This effectively amounts to a decrease in money supply.

Margin requirement is used as a means of controlling stock market speculation. Variations in the margin requirement have substantial selective effect on stock market activities that are independent of the general credit picture.

3. Instalment Credit and Mortgage Control

Central bank can exercise qualitative control of credit by specifying requirements on: (1) minimum down payments, and (2) duration of instalment loans (including mortgages).

For example, many consumer durable goods (e.g. washing machines, computers, televisions) can be purchased using bank credits. If the Central Bank wants to encourage domestic consumption of these consumer durables, the minimum down payment can be reduced, while the period of repayment can be lengthened. This will encourage purchases as consumers need only pay less each month. In times when the economy is experiencing demand-pulled inflation, then the reverse would be implemented.

Mortgage control works in the same way as instalment credit but it is concerned with housing sales. Thus, if it is desired to choke-off housing sales, the Central bank could raise the minimum down payment and reduce the duration of the loan.

Quantitative Controls

1. Open Market Operation (OMO)

This refers to the Central Bank buying and selling of treasury bills and securities.

When the Central Bank pursues a contractionary monetary policy, it will sell treasury bills and securities. Money will be withdrawn from the economy as a result. This effectively reduces the money supply.

When the Central Bank pursues an expansionary policy, it will buy back the treasury bills and securities and thus release liquidity into the economy, thereby increasing the supply of money.

2. Bank Rate (also known as 'Discount Rate')

The Central Bank makes loans to commercial bank. The ‘bank rate’ (or ‘discount rate’, or ‘Federal Funds rate’ as used in U.S.) is the interest rate that banks must pay to borrow reserves from the central bank to meet short-term deficiencies in liquidity. All other market rates of interest are tied to this rate.

When the Central Bank increases the bank rate, this will make interest rates in the economy increase. Borrowing funds become more expensive and investment will decline. This will check inflationary pressure in the economy and therefore has a contractionary effect on the economy.

During times of recession, the bank rate will be reduced when an expansionary monetary policy is pursued.

3. Legal Reserve Requirement (reserve requirement ratio)

There is a minimum reserve requirement that each commercial bank must adhere at all times. This is a percentage of the deposit that must be kept by the bank, and it cannot be loaned out.

The Central Bank has the power to increase or reduce this legal reserve requirement. This will directly impact the ability of the commercial bank to create credit and thus influences the money supply.

For example, in times of inflation, the reserve requirement may be increased to reduce money supply.

Conversely if the Central Bank wants to increase the money supply during a recession, it can lower the legal reserve requirement.

4. Special Deposits

At times, the Central Bank will require commercial banks to keep special deposits at the Central Bank in order to tighten credit. These deposits are compulsory and cannot be withdrawn during the time period it is required. During inflation, special deposits will be increased to tighten credit.