Inflation

Real GDP vs Nominal GDP

Gross Domestic Product (GDP) is the country’s total value of all its consumer spending, government spending, firms’ investments, and net exports. It also provides us an estimate of how much goods and services that the country is producing in a given year.

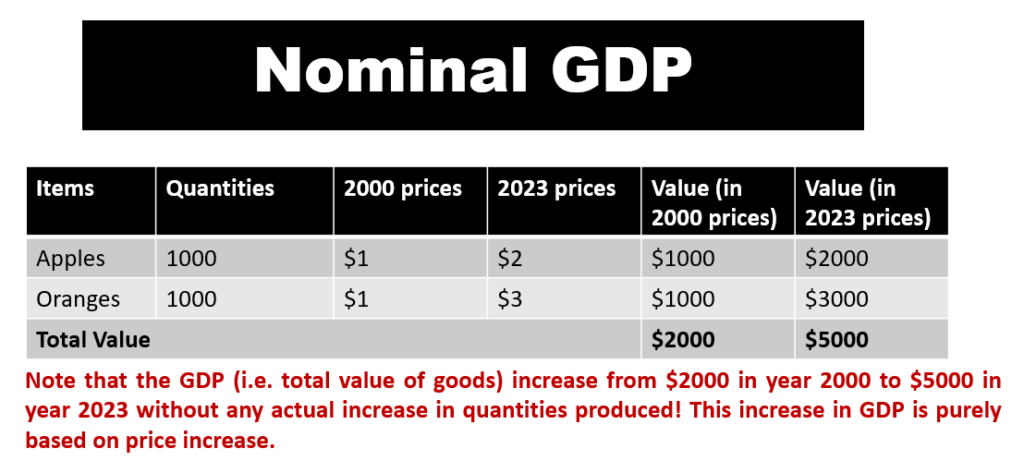

Nominal GDP is simply the GDP that is based on “current dollar” without considering inflation. In short, GDP is simply spending in the economy, and nominal GDP uses the current prices of goods to do this calculation. That is, we simply take the quantities of goods produced multiply by the current prices. This is a simple calculation, but it can also be quite misleading. Let’s take a look at a simple example focusing on a basket of goods comprising of apples and oranges.

- The table shows a country producing only apples and oranges.

- In year 2000, the GDP was $2000. i.e. ($1*1000) + ($1*1000) = $2000.

- In year 2023, the GDP becomes $5000. i.e. ($2*1000)+($3*1000) = $5000.

- We just more than doubled the GDP simply by changing the prices of goods!

Why is this material?

The purpose of tracking the GDP is to help us get a sense of how “productive” the country is over time. Is it producing more goods than previous years? How productive is it as compared to another country over the same period? However, calculating the GDP using current prices (i.e. nominal GDP) gives us a misleading result. The increase in GDP is purely based on price increase, and it has nothing to do with productivity. Hence, we need a better measure of GDP. This is where real GDP comes in.

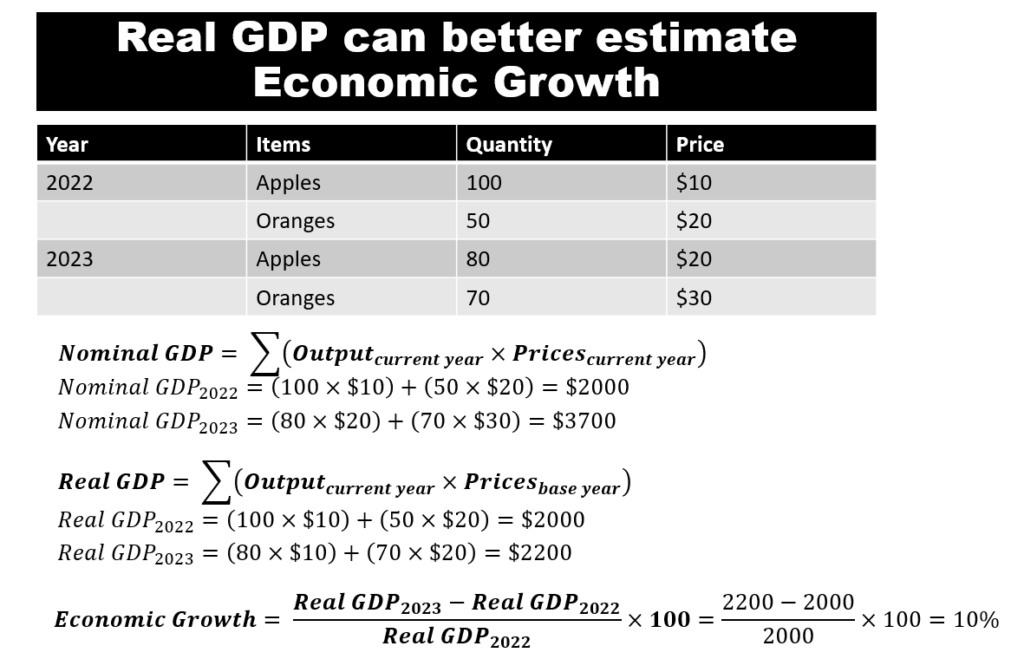

- GDP can change over time due to two things: (1) an increase in output; (2) a change in prices.

- So the objective of using the real GDP is to isolate the price effect, so that we can better compare the output effect.

- In nominal GDP, we are using current year prices to calculate the total value of goods produced in a country in a given year.

- However, in real GDP, we are using the base year prices to calculate the total value of goods produced in a country in a given year. This can enable us to better estimate output and hence economic growth.

#1 GDP Deflator

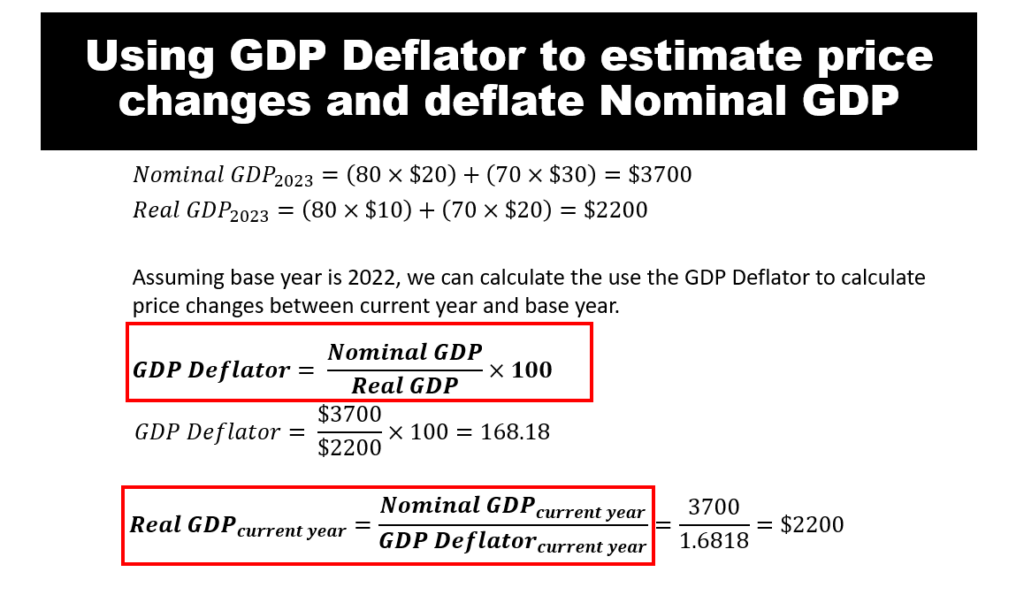

One way to measure changes in price level (i.e. inflation and deflation) in the economy is to use a GDP deflator. This is essentially a ratio of nominal GDP over the real GDP of the same year.

- The formula for the GDP deflator is taking the nominal GDP divide by the real GDP. We can make multiply by 100 or simply express it as a percentage.

- Using our apples and oranges example, the GDP deflator of 2023 is 168.18. This means that the price level has risen by 68% since 2022. Another way of looking at it is that using our dollar in 2022, we can buy 68% more things than using 2023 dollar.

- Normally, we are given both the GDP deflator and the nominal GDP for every year. We can simply calculate the real GDP of that year by dividing the nominal GDP by the GDP deflator.

#2 Consumer Price Index (CPI)

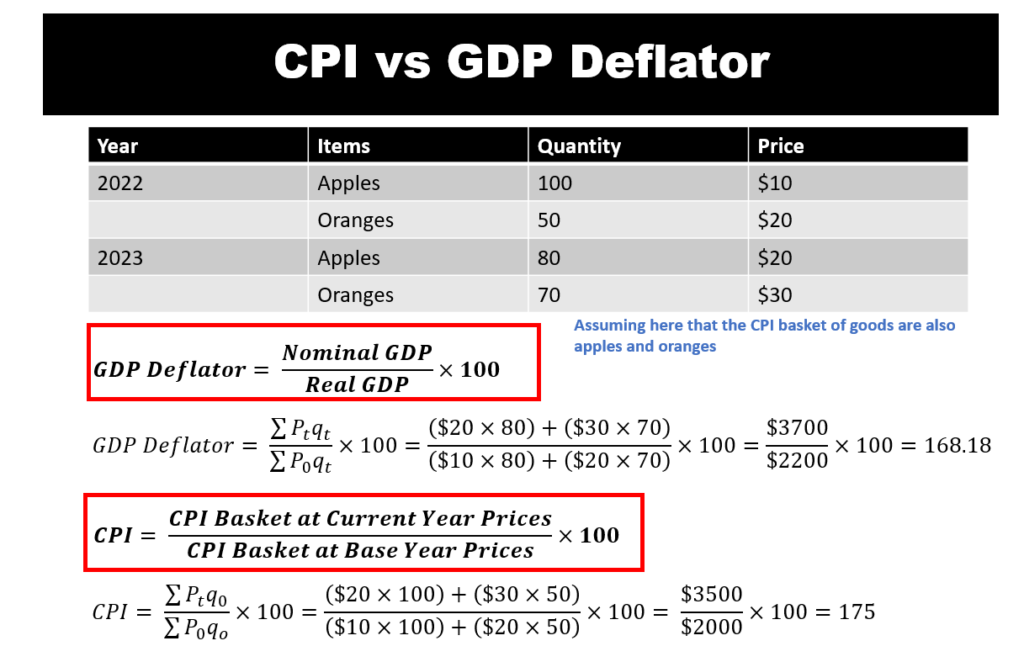

Another way to measure changes in price level (i.e. inflation/deflation) in an economy is to use the Consumer Price Index (CPI). This is also a ratio, but uses CPI of a basket of goods in current prices over that of the base year.

The key thing to note is that CPI is designed for measuring price changes for consumers, while the GDP deflator is a board-based tool, looking at all goods in general. Hence, the basket of goods involved in the CPI calculation is based on items that consumers typically buy. This is in turn based on studies and surveys conducted by the government, and it may differ from country to country. The CPI essentially looks at how price changes for a fixed basket of consumer goods over time.

CPI is commonly used to measure inflation as it can give us a sense of how inflation affects the average citizens like you and me.

- GDP deflator measures prices of all goods and services produced, whereas CPI measures the prices of goods and services that concern the consumers.

- GDP deflator only looks at goods that are produced domestically.

- CPI is computed based on a fixed basket of goods, whereas the GDP deflator allows the basket of goods to change over time. Hence, the limitations of CPI are that it cannot account for substitution effect, quality differences, and changes in spending habits over time.

Inflation

Inflation refers to a rise in prices of goods and services in the economy. When there is inflation, there will be a decline in purchasing power over time.

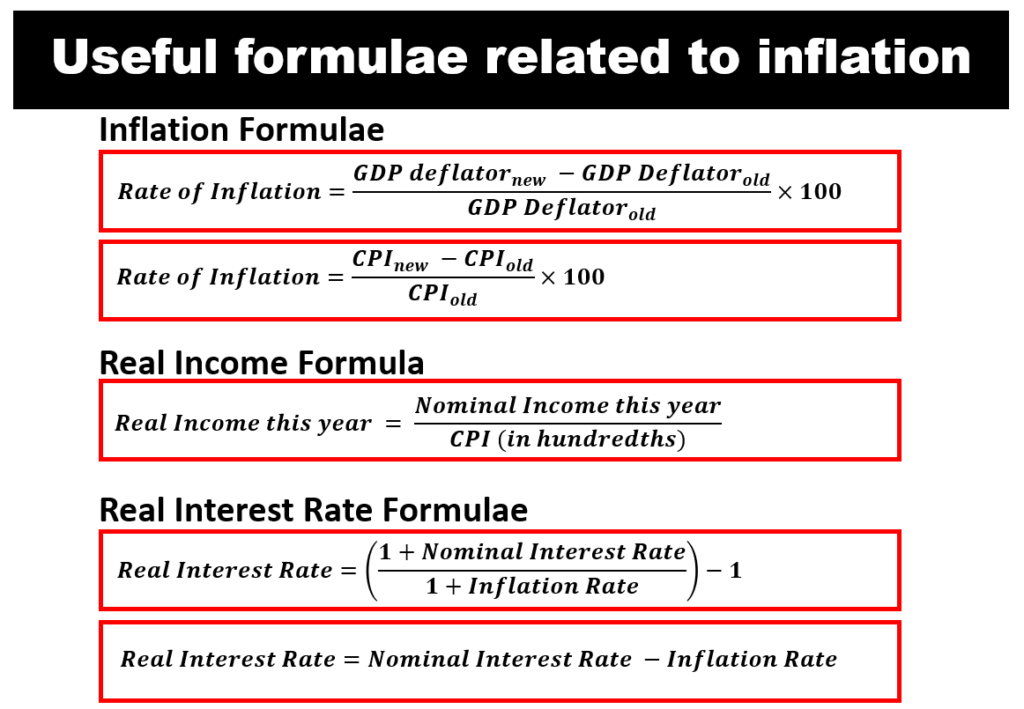

- We can either use the GDP Deflator or CPI to calculate inflation rate. Between the two measures, CPI is more popular.

- We can also use CPI to deflate nominal income to derive the real income. E.g. Let’s assume that your nominal income in 2022 is $100,000, and the inflation rate for that year is 150. Then your real income in 2022 is = $100,000/1.50 = $66,666.67.

- The real interest rate formula is a common formula that uses inflation rate. A good approximation of real interest rate is simply using nominal interest rate less off the inflation rate.

Causes of Inflation

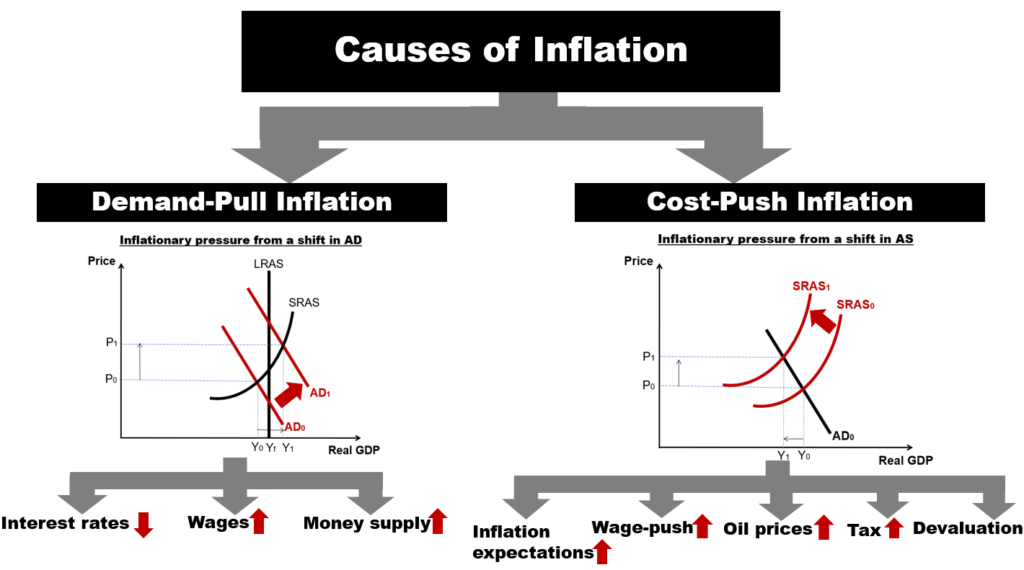

#1 Demand-pull inflation

Demand-pull inflation is a situation where aggregate demand is growing faster than aggregate supply. This is a situation where too much money is chasing after too few goods. This can happen when:

- Interest rate decreases — hence leading to excessive borrowing and spending.

- Wage increase — hence incentivising consumers to spend more.

- Money supply increase — hence leading to too much money circulating in the economy. This will result in too much money chasing too few goods, and that in turn will bid prices of goods up.

- Consumer confidence increase — this will lead to more spending by consumers.

#2 Cost-push inflation

Cost-push inflation is a situation where the aggregate supply in the economy contracts. This can happen mostly when the cost of production, or its expectation, increases. For instance:

- Inflation expectation increases — if firms expect high inflation, they will factor in this increase in the prices of their goods that they are selling.

- Wage-push inflation increases — this is the case where the bargaining power of workers is high. Higher wages mean higher costs from the firms’ perspective. Firms, in turn, are likely to increase prices of their goods to pass on the higher costs to consumers. Note: wage-push inflation may also be linked to inflation expectation. That is, workers and unions may bargain for higher wages when they expect inflation to increase.

- Oil price increases — Oil is a key resource to produce goods and services. Hence, firms will mark-up prices of their goods to pass on the higher costs to consumers.

- Higher taxes — will lead to higher cost of production. For instance, firms will need to pay higher prices for their raw materials. They will then revise up the prices of their goods to consumers and other firms.

- Devaluation — will weaken the domestic currency, and that in turn will make imports more expensive. This will affect firms who source their raw materials overseas. In turn, these affected firms will mark-up prices of their goods, thereby leading to higher inflation.

- Other reasons: declining productivity and profit-push by firms may also lead to higher inflation.

Effects of Inflation

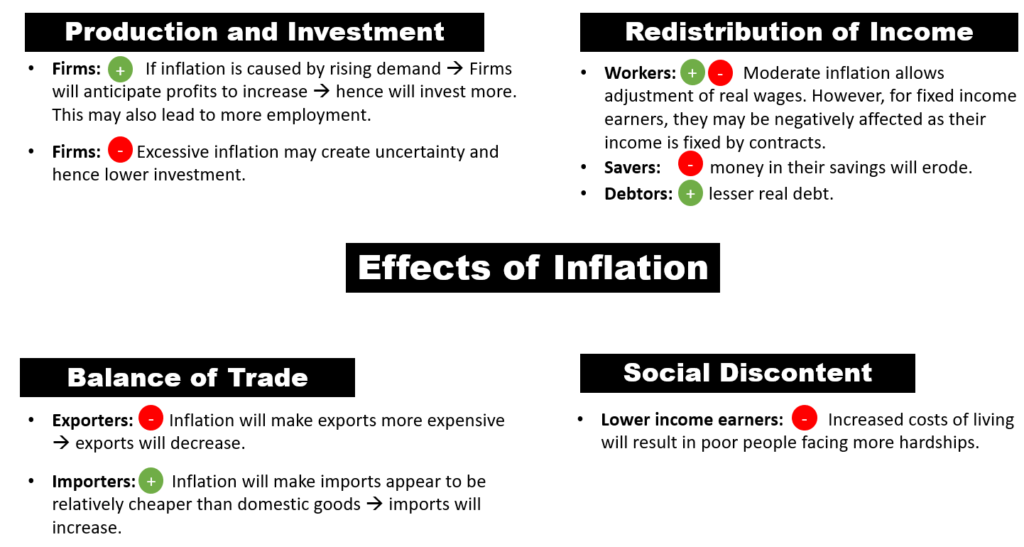

Inflation affects different players disproportionately. There will be winners and losers.

- Firms — some degree of moderate inflation can bring about optimism. It can signal rising profit, and that will in turn prompt firms to invest more in their production capacity, as well as their staff strength. However, excessive inflation can have the opposite effect.

- Workers — workers can see their real wages increase as a result of inflation. However, this in turn depends on whether their contracts can be revised to keep pace with inflation. It also depends on their wage-bargaining powers.

- Savers/ Lenders — tend to lose out as their real money will decrease.

- Debtors/Borrowers — tend to gain, as their real debt is lesser.

- Exporters — tend to lose out as inflation will make exports more expensive.

- Importers — tend to gain as higher inflation of domestic goods will make foreign goods appear relatively cheaper. This will lead to an increase in imported goods.

- Lower income earners — will lose out because of inflation. This includes grappling with higher living costs, and an inability to afford certain goods and services such as housing and education.

Controls of Inflation

#1 Contractionary Monetary Policy

- Monetary policy refers to the deliberate attempt by the Central Bank to regulate the level of economic activities by controlling the money supply; the level of interest and other conditions affecting the availability of credit.

- To fight inflation, the appropriate monetary policy is to reduce aggregate demand by adoption a ‘tight’ money policy. To pursue such a policy would entail the Central Bank taking measures to increase the costs of borrowing and reduce the credit creating capacity of the commercial banks.

- The Central Bank can use tools such as open market operations, bank rate and cash reserve ratio to pursue a ‘tight’ monetary policy.

#2 Contractionary Fiscal Policy

- Typically, a contractionary monetary policy is used to control high inflation. However, sometimes the government also steps in to support inflation control with a contractionary fiscal policy. This is especially so if the inflation is persistently high despite rounds of intervention.

Fiscal policy has to do with adjusting government tax revenue and expenditure. Fiscal measures include:

#1 reduction in government spending. This will reduce aggregate demand.

#2 the imposition of new taxes or increasing existing ones. This will directly

reduce the size of disposable income and cut consumption expenditure.

#3 Supply-Side Policies

- Supply-side policies are a form of fiscal policy that are designed to boost the economy’s productivity and efficiency. This will place downward pressure on long-term costs. In terms of the AD-AS model, a supply-side policy is represented by a shift of both short-run and long-run aggregate supply to the right.