Money Multiplier

The Banking Circular Flow Model

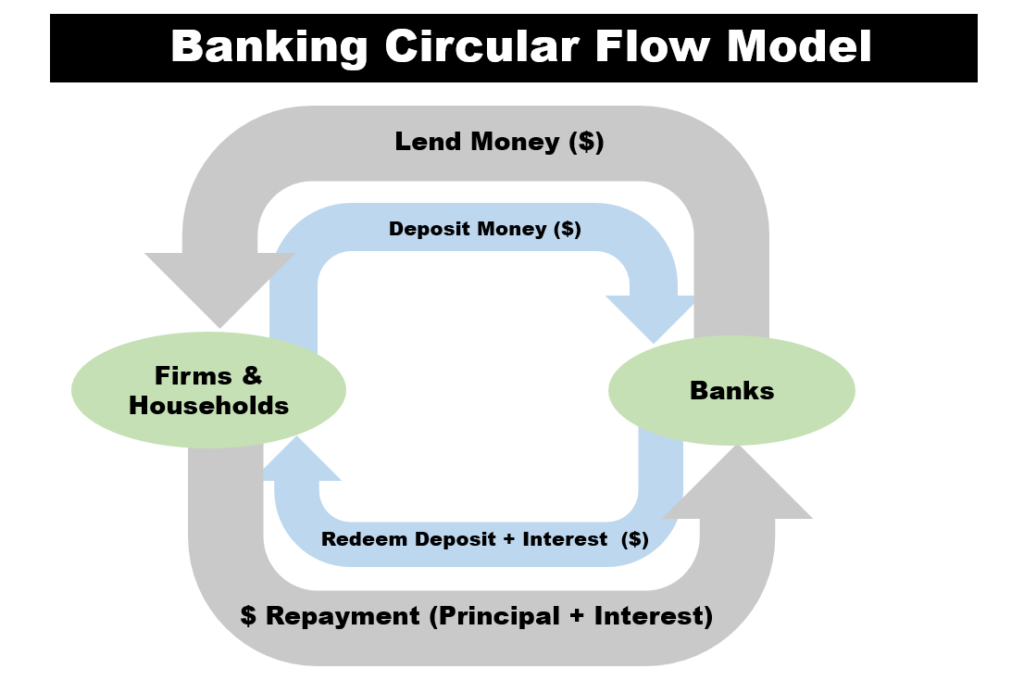

In this section, we shall focus on the money flow between banks and firms and households. We shall also realise that there is a similar money multiplier process going on as money circulates in the economy between these players. For simplicity, we shall treat firms and households together as a single entity. The diagram below captures the relationship and money flow between banks and firms/households. The Central Bank is able to control the money creation process by controlling the reserve ratio that commercial banks must maintain. This system is also known as fractional reserve banking.

Some of the related concepts are covered in earlier sections. For instance:

- In an earlier section, we painted a picture of the circular flow of money in the economy. This is a high-level picture that incorporates how money flow between the major players – including firms, households, government, and banks – in the economy.

- In another section, we also note that money expands as it circulates in the economy. Specifically, we zoom in and focus on the money flow between households and firms. Since, this is predominantly driven by consumption, we call this money expansion the “Spending Multiplier“.

Where do banks get their monies from? Banks get their monies from people (essentially firms and households) who deposit their monies in banks. They do so because they can gain back their deposits any time as well as to earn interests on those deposits.

How do banks earn monies to pay interests to depositors? Banks lend monies to borrowers (comprising other firms and households) who need the monies to bridge certain financing needs. Banks then get back their loan principal and interests at some future point in time. The interest rates they charge for lending monies will of course be higher than the interest rates they give out to depositors.

Fractional Reserve Banking

Banks are restricted by the Central Bank from lending out all the monies that they receive from depositors. Essentially, banks can only lend out a fraction of their banks deposits to maintain liquidity in the event that a few depositors withdraw their money. So fractional reserve banking is a system whereby banks can lend out a certain amount of deposits that they have in their balance sheets. This additional amount of money loan out actually expands the size of the money beyond the original money stock. In a way, this is a “money creation” process.

The Central Bank mandates a certain reserve ratio (RR) that all commercial banks need to follow. Let’s say this RR is 0.2. This means that the cash reserves that banks need to keep must be 20 percent of their total deposits. So the formula is: RR = cash reserves/total deposits.

The Money Multiplier

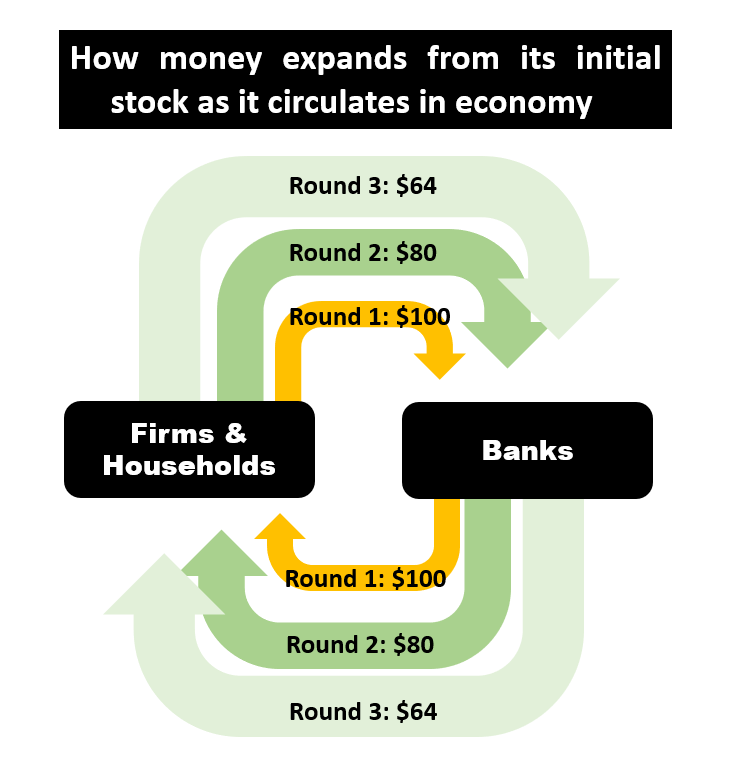

Let’s us now do a deep-dive to better understand the “money creation” process.

Round 1: Let’s assume that banks increase lending by $100 (i.e. injection of new Money in Economy). Banks lend out this $100 to borrowers (largely firms and households).

Borrowers typically use the $100 to transact with other firms and households. Eventually, the recipient(s) of the $100 will deposit it back into banks.

Round 2: Assuming a reserve ratio (RR) of 0.2, banks need to keep $20 as reserve, and can only lend out $80 of the $100 they receive in the next round. This $80 will be circulated in the economy, which again will find its way back to banks.

- Round 3: Banks receiving the $80, can only lend out $64 (as they need to maintain 20% of it as reserves). The cycle then repeats.

- The money so far is now: $100 (initial stock) + $80 + $64 = $244.

In a way, the reserve ratio (RR) in the bank money multiplier is akin to the Marginal Propensity to Save (MPS) in the Spending Multiplier. To calculate the total money in the economy as a result of the new money stock being injected, we use the formula:

Total Money = Money Injected (M) * 1/(RR)

In our example, total money is = $100 * (1/0.2) = $500.