Crowding Out Effect

Crowding-Out Effect of Fiscal Policy

In a recession, a government may wish to use a discretionary fiscal policy to increase Aggregate Demand (AD). This is so that the economy can be at (or close to) its full employment level. The government can engineer this expansionary fiscal policy by either reducing taxes (T) or increasing government expenditure (G), or both. If the government decides to increase its government expenditure (G), the key question is how it is going to be financed.

If the government has a lot of reserves, it can draw down on these reserves to finance this budget deficit.

Alternatively, the government can also finance this budget deficit through borrowing (by selling government bonds). However, this option has an undesirable side-effect. It may inadvertently reduce the supply of loanable funds as money is used up to purchase the issued government securities.

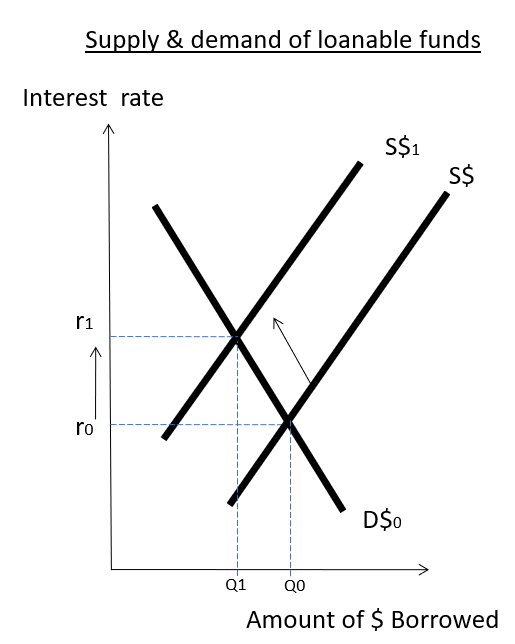

The left diagram shows a reduction in the amount of loanable funds from Q0 to Q1. As there are less funds to be loaned out, new borrowers may need fork out higher interest rate to borrow the remaining loanable funds. Interest rates will thus increase from r0 to r1.

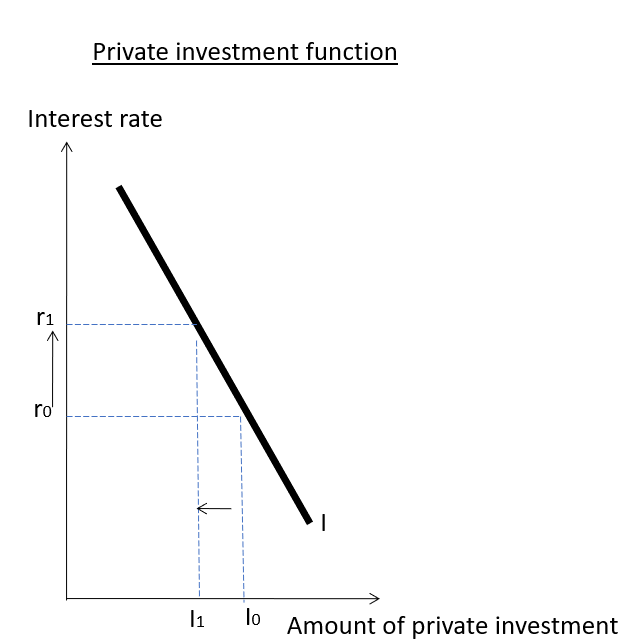

The increase in interest rate makes the cost of borrowing expensive. As a result, companies may decide to borrow less, and hence private sector investment (I) decreases from I0 to I1.This is evident in the diagram on the right. This drop in private sector investment (I) will dampen Aggregate Demand (AD), working against the expansionary fiscal policy.

The net effect is that Aggregate Demand (AD) may still increase because of the increase in government expenditure (G), but to a lesser extent due to the crowding out effect of private sector investment (I).

Crowding-In Effect of Fiscal Policy

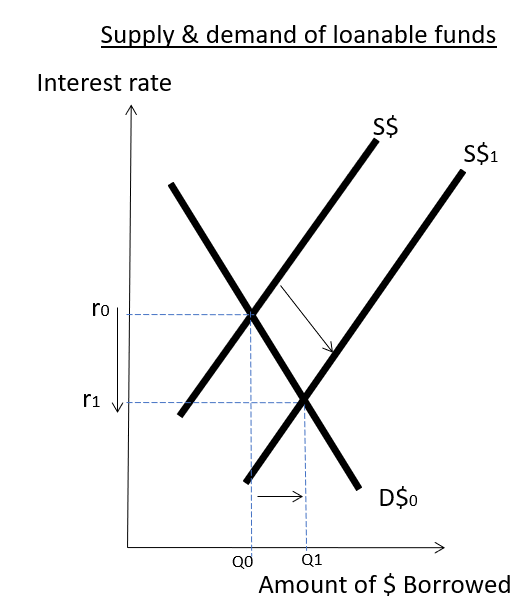

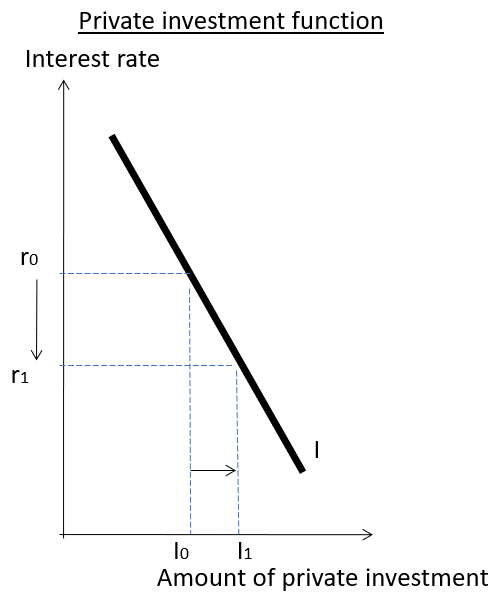

If the government had earlier issued bonds to finance a budget deficit, it may eventually need to redeem its bonds. This bond redemption may trigger an injection of loanable funds in the market from Q0 to Q1. Due to this sudden surplus of loanable funds, the interest rate will be reduced from r0 to r1, as shown in the following left diagram. The reduction in interest rate will prompt an increase in private sector investment. This is evident in the following right diagram as a movement from l0 to l1 of the investment function This increase in investment (I) will increase the Aggregate Demand of the economy.

Depending on the state of the economy when the government bonds are redeemed, this may potentially pose some economic disruptions. For instance, the economy could be in a state of high inflation, and may be at a time when the government or the monetary authority wishes to dampen the overheated economy using contractionary policies. The crowding-in effect that is triggered by the loan redemption would increase the Aggregate Demand, thereby mitigating the effect of the contractionary policies.

Separately, crowding-in effect may not be much of a problem in other scenarios. It can at times reinforce the effect of expansionary fiscal policy. This can happen when the economy is in deep recession. In this case, there is already a surplus of loanable funds. Hence a borrowing-financed expansionary fiscal policy may not lead to any crowding out effect.

On the contrary, the expansionary fiscal policy can lead to more economic growth. How? The expansionary fiscal policy may increase employment. More jobs will lead to both higher income and savings. In turn, this increased savings will lead to more private sector investment, thereby further increasing Aggregate Demand.