Monopoly & Efficiency

Monopoly efficiency overview

The big question: “How does perfect competitive market vs monopoly?”. In this section, we shall compare the efficiency of monopoly with perfect competition. In previous section, we note that perfect competition is efficient for society. In contrast, a monopoly does not have productive efficiency nor allocative efficiency.

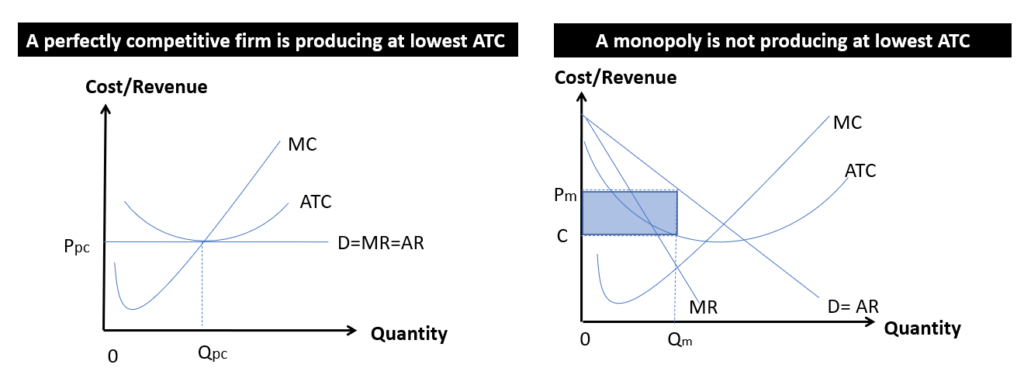

Monopoly does not have productive efficiency

A perfectly competitive firm produces at lowest Average Total Cost (ATC). We can also say that the entire industry. Hence, it has productive efficiency. This is true for all firms in the same industry.

In contrast, a monopolist does not produce at lowest Average Total Costs (ATC). Hence, it is not operating at a level of productive efficiency.

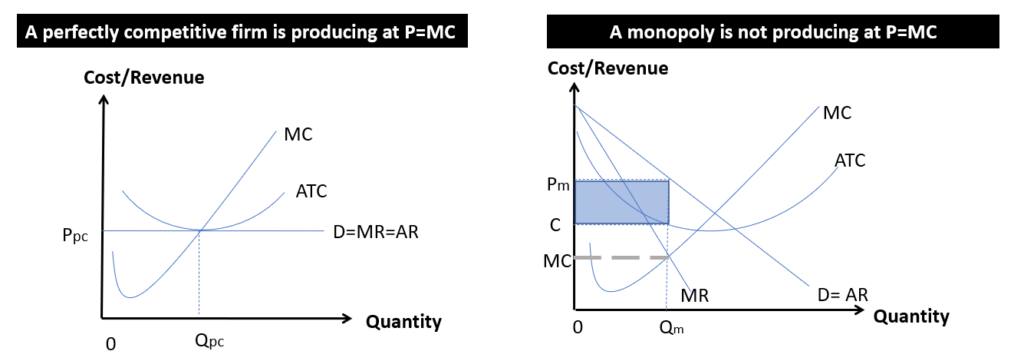

Monopoly does not have allocative efficiency

#1 It does not produce at P=MC

A perfectly competitive firm produces at a level where the price is equal to the marginal costs (i.e. P=MC).

However, a monopolist will attempt to produce at output (Qm) where it can maximises profit. However, its price (Pm) will then be above its marginal cost (MC). Hence, there is no allocative efficiency.

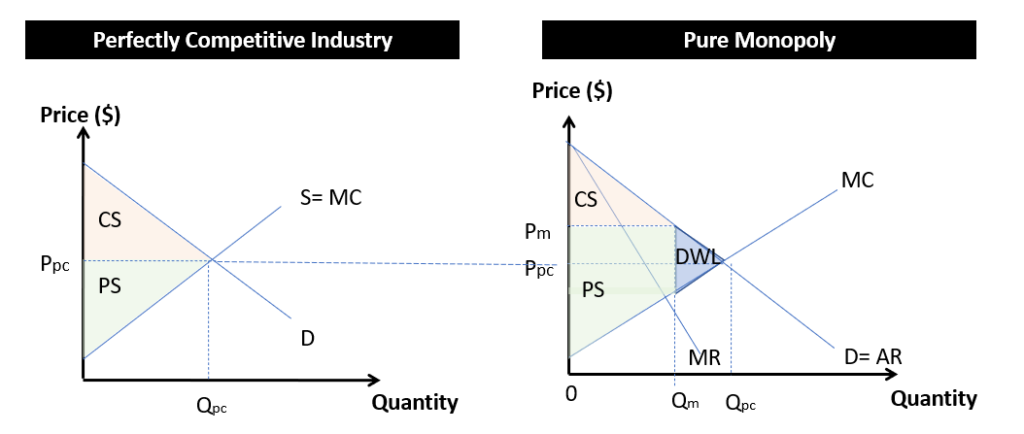

#2 Consumer and producer surplus not optimised

In perfect competition, society produces at a point where the producer surplus (PS) and consumer surplus (CS) is maximum. This also means that the welfare to the society is maximised. Any deviation from this situation will, result in dead weight loss (DWL).

The monopoly scenario portrays such a situation. The monopolist produces less goods than what market demands, and hence is able to charge a higher price for it. It thus captures more producer surplus (PS), while resulting in a smaller consumer surplus (CS) and a dead weight loss (DWL). This is also indicative of allocative inefficiency.

Regulation of monopoly

#1 Impose a price ceiling to achieve a socially optimal price

- One way to regulate the Monopoly is to establish a legal (ceiling) price for the monopolist that is equal to marginal cost (i.e. P=MC). At this point, allocative efficiency is achieved.

- This is also called the “socially optimal price”.

However, this intervention can be overly harsh, and it may lead to operational losses and bankruptcy. Hence, other attendant interventions may be necessary. Options include:

- Option 1: provide a subsidy to cover the loss that marginal cost pricing would entail.

- Option 2: allow price discrimination and hope that additional revenue gained will permit the firm to cover costs.

#2 Impose a fair-return price

- Instead of imposing a “socially optimal price”, the government can also consider imposing a “fair-return price”. This is where the price would be on the ATC curve, hence allowing the monopolist to at least covers its ATC.

- This means that the monopolist can only earn normal profit by getting it to charge at the fair-return price.